Reversion from chronic migraine to episodic migraine following treatment with erenumab: Results of a post-hoc analysis of a randomized, 12-week, double-blind study and a 52-week, open-label extension - Richard B Lipton, Stewart

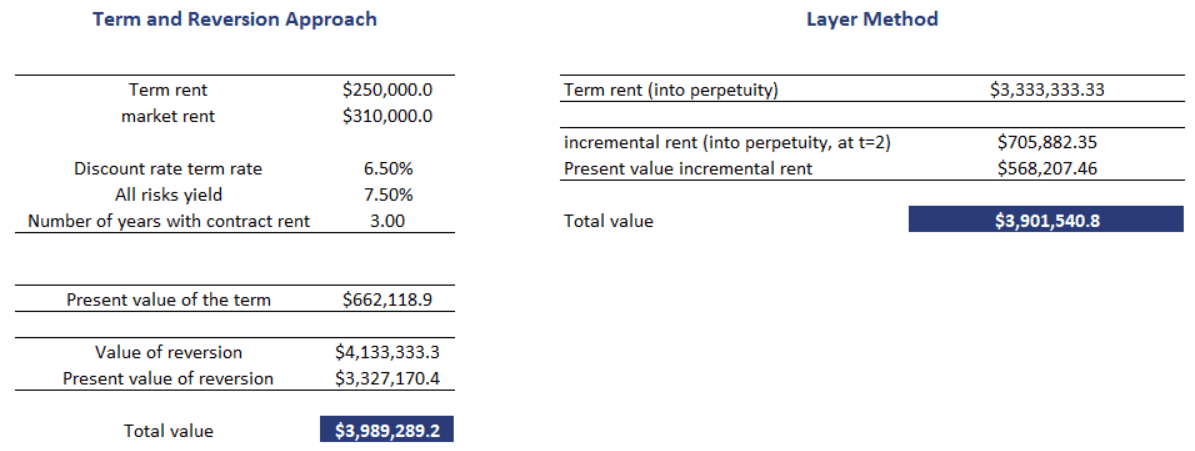

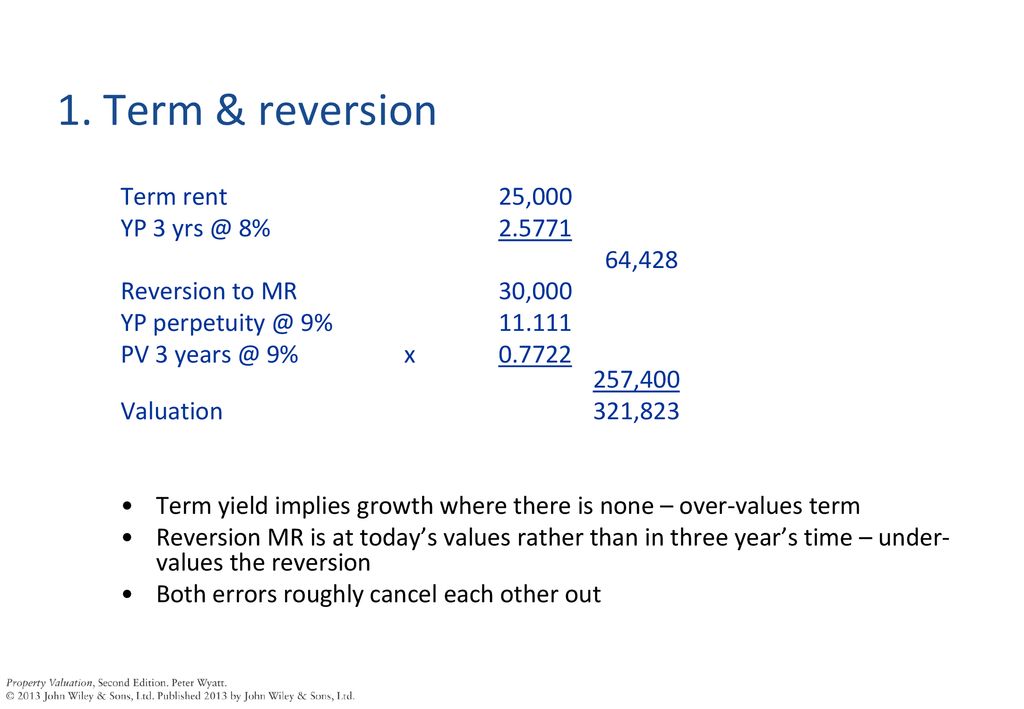

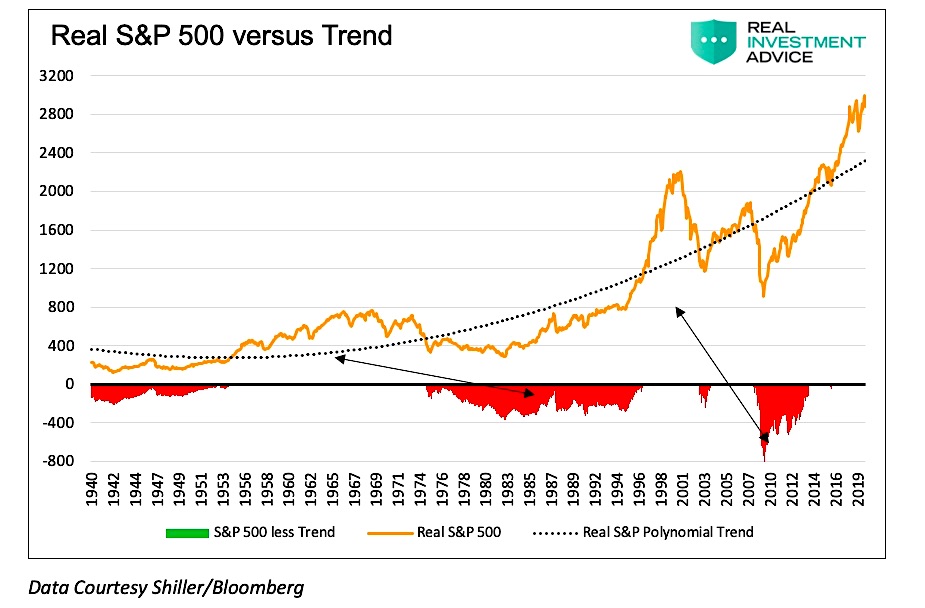

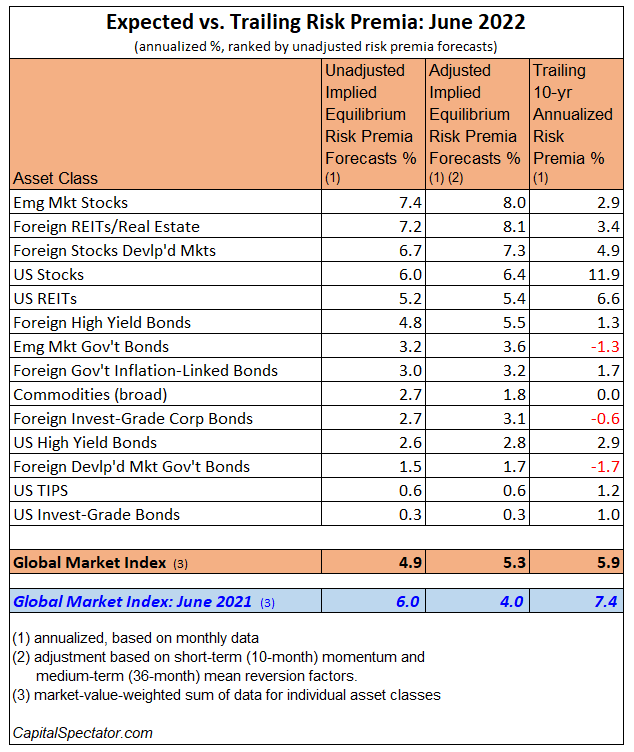

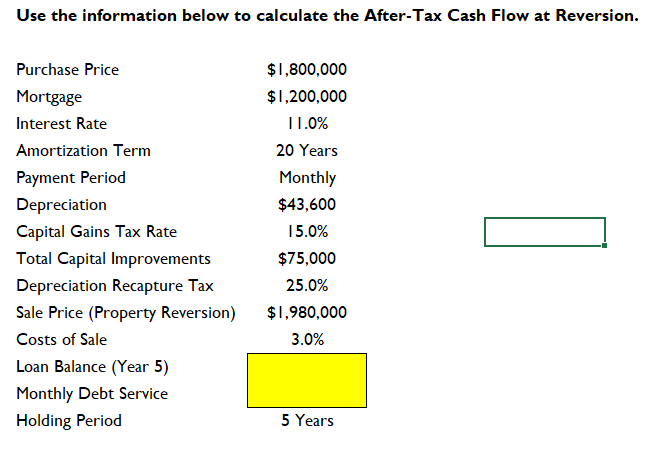

Real Estate Investment & Market Analysis Lecture 1: Introduction – value, worth, applications, methods Tony Key Professor Real Estate Economics Room 5087, - ppt download

![PDF] Introducing Property Valuation | Semantic Scholar PDF] Introducing Property Valuation | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/7e72adc956d0f320b5e99f41e49c735d462339fa/234-Figure11.5-1.png)