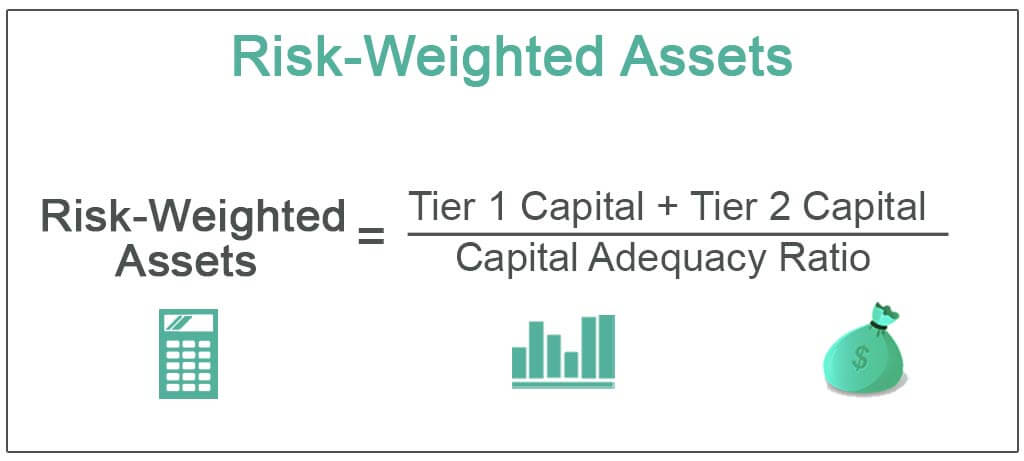

What does RORWA mean? - Definition of RORWA - RORWA stands for Return on Risk Weighted Assets. By AcronymsAndSlang.com

Federal Register :: Regulatory Capital Rules: Implementation of Risk-Based Capital Surcharges for Global Systemically Important Bank Holding Companies

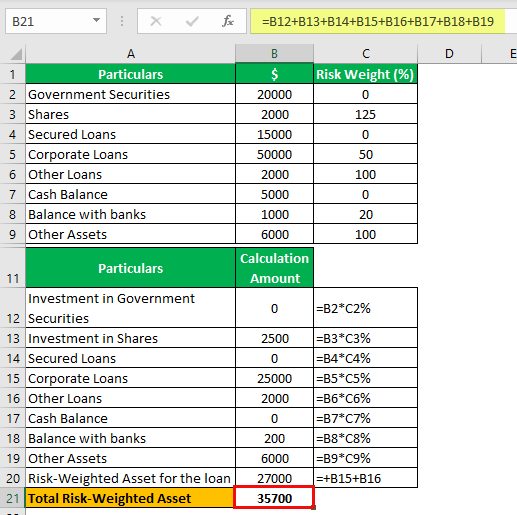

Notes for Accounting in Banks | ACC4761H - Accounting and Business Analysis for Banks - NUS | Thinkswap