Quizás en 1998 se gestó la semilla de la destrucción en el Sistema financiero mundial – El Blog de finanzas y economía de Marc Garrigasait

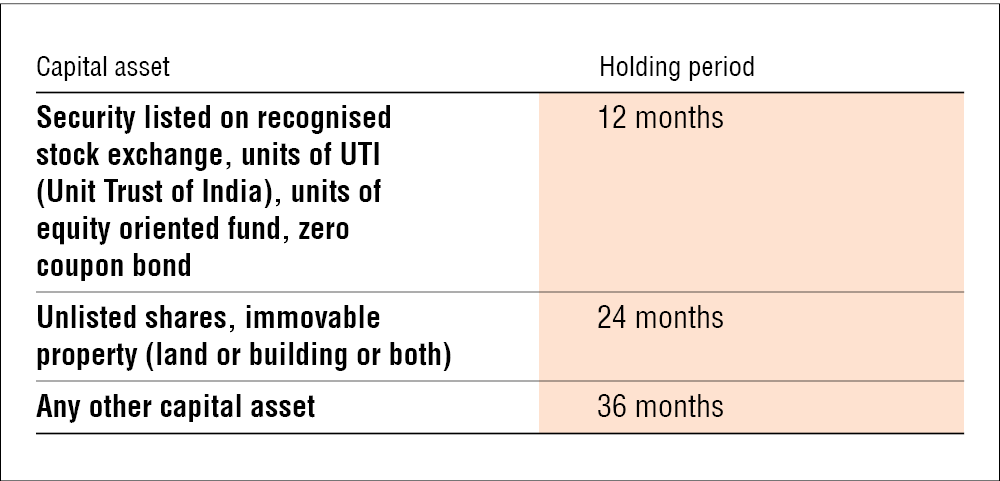

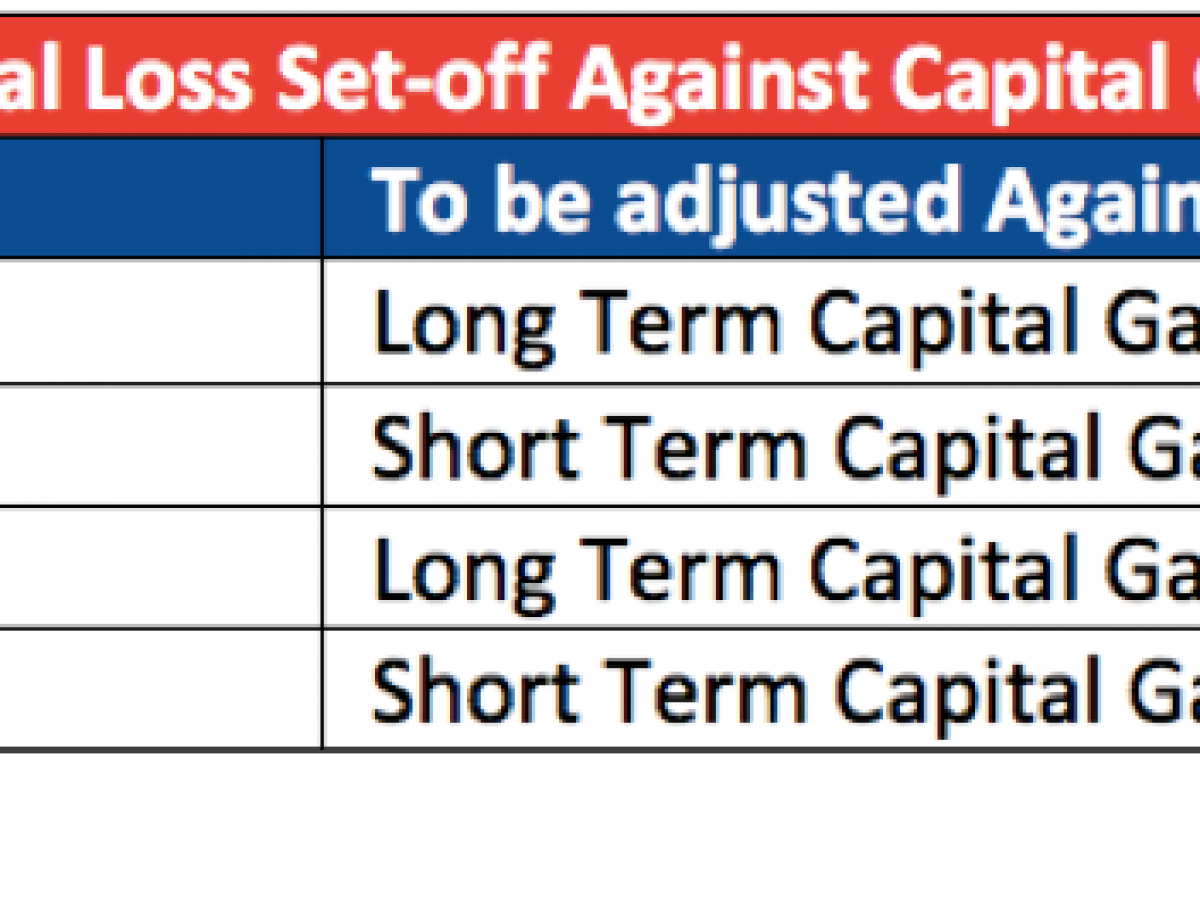

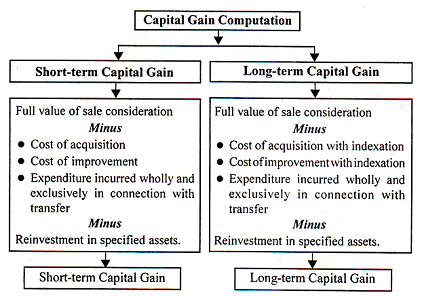

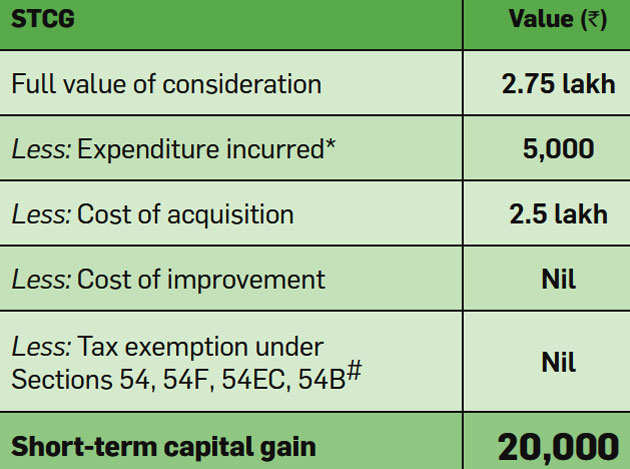

capital gain: How to calculate short-term and long-term capital gains and tax on these - The Economic Times

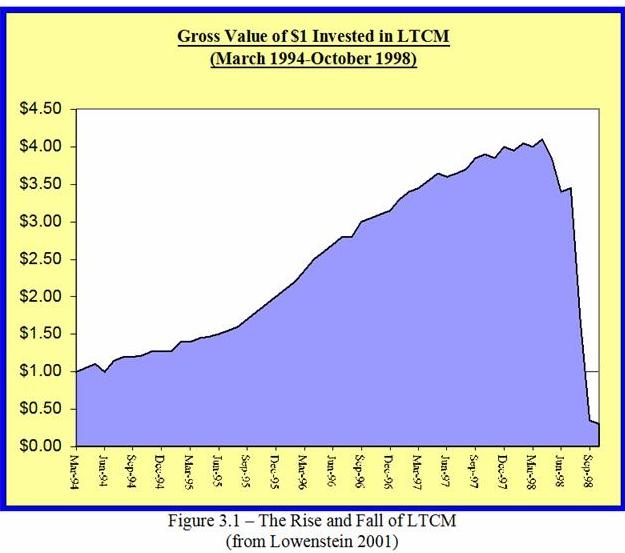

![PDF] VALUE AT RISK: ANY LESSONS FROM THE CRASH OF LONG-TERM CAPITAL MANAGEMENT (LTCM)? | Semantic Scholar PDF] VALUE AT RISK: ANY LESSONS FROM THE CRASH OF LONG-TERM CAPITAL MANAGEMENT (LTCM)? | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/ccaa49c44e7923dcc6e66beaf300f938e3562a53/6-Table1-1.png)

PDF] VALUE AT RISK: ANY LESSONS FROM THE CRASH OF LONG-TERM CAPITAL MANAGEMENT (LTCM)? | Semantic Scholar