Comparative analysis of interest rate term structures in the Solvency II environment | Emerald Insight

Technical documentation of the methodology to derive EIOPA's risk-free interest rate term structures

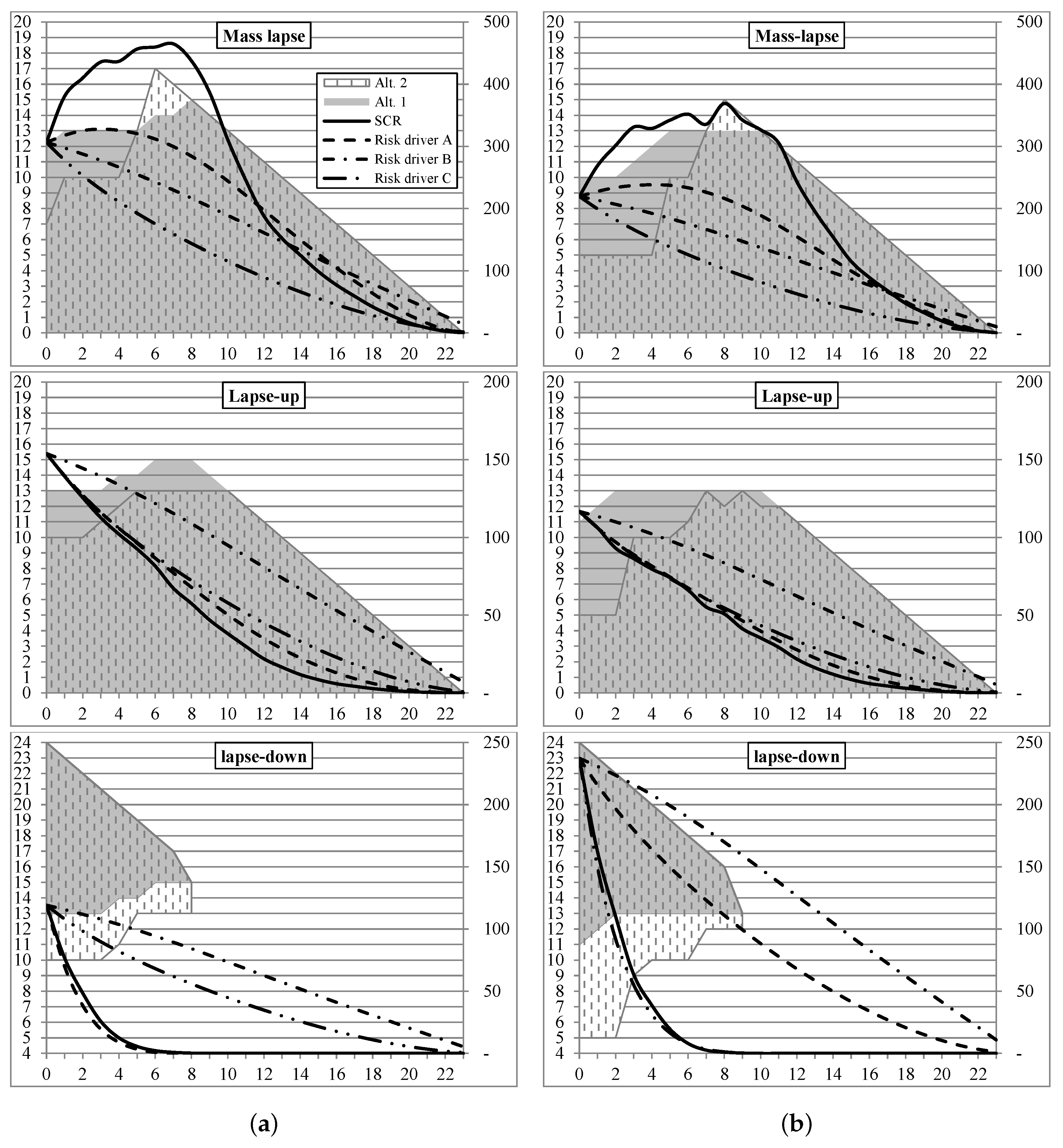

Risks | Free Full-Text | Surrender Risk in the Context of the Quantitative Assessment of Participating Life Insurance Contracts under Solvency II

EIOPA publishes corrected updated representative portfolios to calculate volatility adjustments to the Solvency II risk-free interest rate term structures for 2023

An analysis of the Solvency II regulatory framework's Smith-Wilson model for the term structure of risk-free interest rates - ScienceDirect

An analysis of the Solvency II regulatory framework's Smith-Wilson model for the term structure of risk-free interest rates - ScienceDirect

An analysis of the Solvency II regulatory framework's Smith-Wilson model for the term structure of risk-free interest rates - ScienceDirect